Are You Worried About Running Out of Money in Retirement?

Let’s talk about a smart, proven method to retire rich — and stay rich.

What Will You Learn in This Blog?

-

What is the 4.8% SWP Rule?

-

How this rule works better than traditional retirement tools

-

How it helps you beat inflation effortlessly

-

Why mutual funds make this rule possible

-

Simple, bullet-style explanation for easy understanding

-

Real-life benefits: Peace of mind, monthly income & capital growth

-

Final recap with verdict to help you decide confidently

What is the 4.8% SWP Rule?

-

SWP = Systematic Withdrawal Plan.

-

The 4.8% Rule means withdrawing only 4.8% of your mutual fund corpus every year.

-

This keeps your capital mostly intact — and may even grow.

-

You get a monthly income without depleting your wealth.

-

It’s smarter than the old 4% rule in today's Indian market conditions.

Why 4.8% and Not 4%?

-

India’s mutual fund returns are higher than developed countries.

-

Historical equity mutual fund returns in India: ~12-14% p.a.

-

Inflation averages around 6-7%.

-

4.8% is a sweet spot: Enough for regular income + capital appreciation.

-

Research-backed and inflation-proofed for Indian retirees.

How Does SWP Actually Work?

-

You invest a lump sum in mutual funds (preferably hybrid or equity-oriented).

-

You opt for SWP at 4.8% of the invested amount per year.

-

Mutual fund house pays you a monthly payout from your own investment.

-

The rest of your corpus continues to grow in the market.

Inflation? What Inflation?

-

Your invested money isn’t sitting idle like in FDs.

-

It’s growing, compounding, and beating inflation quietly.

-

Mutual funds help your capital grow, unlike traditional savings methods.

-

You enjoy both income and wealth creation!

Why Not Just Use Fixed Deposits Instead?

-

FDs give 6-7%, but are tax-inefficient.

-

FD interest is taxed fully every year.

-

No growth potential — only interest.

-

SWP in mutual funds? Tax-efficient, flexible, and profitable.

-

You only pay tax on the withdrawn gains

Best Mutual Funds for SWP

-

Hybrid Equity Funds (Balanced Advantage, Aggressive Hybrid)

-

Equity Savings Funds

-

Choose funds with consistent performance over 5+ years or consult a Mutual Fund Advisor

Do you know you can plan your monthly income just like a salary during retirement?

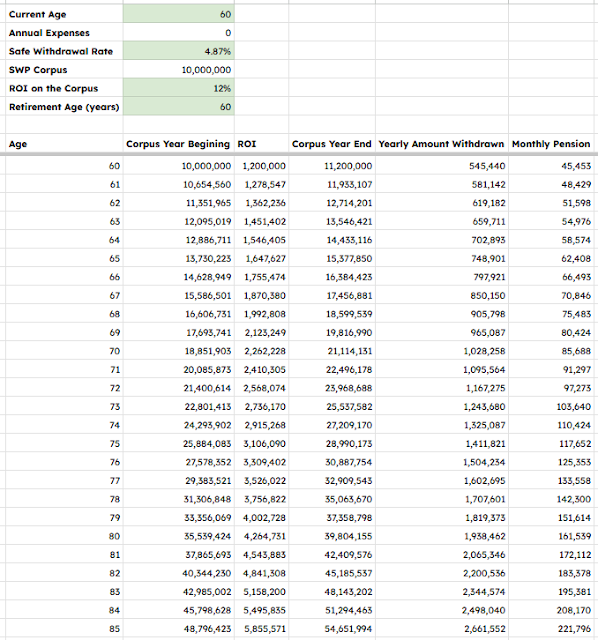

Real-Life Example: How Much Monthly Income Can You Really Get?

Let’s break it down with a real and practical example using the 4.8% SWP Rule on a ₹1 crore retirement corpus.Can your investments give you a growing monthly income for life?

Starting Retirement at Age 60:

- Corpus Invested: ₹1,00,00,000 (₹1 Crore)

- Annual Withdrawal Rate: 4.8%

- Return on Investment (ROI): 12% annually

- SWP Mode: Monthly pension starting at ₹45,453

How Does It Grow Over Time?

Even while withdrawing money every year, your corpus keeps growing due to a higher return than withdrawal rate.

Here’s how:

Age 60:

-

ROI Earned: ₹12,00,000

-

Corpus Grows to: ₹1.12 Crore

-

Annual Withdrawal: ₹5,45,440

-

Monthly Pension: ₹45,453

Age 65:

-

Corpus Becomes: ₹1.54 Crore+

-

Monthly Income Rises To: ₹62,408

Age 70:

-

Corpus Crosses: ₹2.1 Crore+

-

Monthly Income Becomes: ₹85,688

Age 75:

-

Corpus Nears: ₹2.98 Crore

-

Monthly Pension: ₹1,17,628

Age 80:

-

Corpus Touches: ₹3.98 Crore+

-

Monthly Income: ₹1,62,054

Age 85:

-

Corpus Hits: ₹5.46 Crore!

-

Monthly Withdrawal: ₹2,21,796

What Does This Mean for You?

-

Your monthly income more than quadruples from ₹45K to ₹2.2L over 25 years!

-

Your corpus grows over 5 times, despite regular withdrawals.

-

You’re not just living on your savings — your money is working for you.

|

| Detailed Illustration |

Would you believe that ₹1 Crore can generate ₹2.2 Lakhs/month in 25 years? Comment Below

SWP Rule = Financial Freedom + Mental Peace

-

No fear of outliving your savings

-

Regular income like a pension

-

Growth even after retirement

-

Flexibility to increase/decrease withdrawal

-

Control stays with you, not the bank

How to Start the 4.8% SWP Plan

-

Step 1: Choose suitable mutual fund(s)

-

Step 2: Invest your retirement corpus

-

Step 3: Set up SWP online or via your mutual fund advisor

-

Step 4: Choose monthly payout frequency

-

Step 5: Review performance every 6–12 months either through DIY or mutual fund advisor

When Should You NOT Use SWP?

-

If your corpus is too small — then it’ll get exhausted fast

-

If you need large lump sums often

-

If your withdrawal rate exceeds 6% p.a.

-

If you’re investing in any volatile or small-cap funds

Extra Tips to Maximise the 4.8% Rule

-

Mix equity and debt funds for balance

-

Start SWP after 1-year holding to reduce tax

-

Reinvest any surplus to grow more

Consult a good Mutual Fund Advisor

Recap: Why the 4.8% SWP Rule is a Game-Changer

-

Offers regular, tax-friendly income

-

Beats inflation while maintaining capital

-

Uses the power of mutual fund growth

-

Customisable & flexible

-

A practical retirement tool for modern Indian investors

✅ Final Verdict

The 4.8% SWP Rule is your golden key to peaceful retirement living.

It gives you monthly income, capital protection, inflation-beating returns, and total control over your wealth.

Forget old-school pensions or FDs. With this simple rule, you become your own boss — even after retirement.

This comment has been removed by the author.

ReplyDeleteThank you for sharing such a wonderful blog. It has truly changed the way I think.

DeleteThanks a lot Rajesh for the encouragement!. :)

DeleteWill keep writing more such ideas